Your Overseas Home

What £300k Can Get You in Europe’s Capital Cities

What is in the article below:

- The most affordable capital cities in Western Europe to buy a property

- Pristina revealed as the best-value European capital city to buy a property

- Stockholm named the most expensive European capital city for property purchase

- Moving abroad? Which popular European capital cities offer the best value for money?

- Which European capital cities offer the largest floor space for your money?

Exploring the European Property Market: What can £300k get you in Europe’s capital cities?

Europe is home to some of the most vibrant capital cities in the world, each known for its rich history, glorious architecture and diverse culture. Living in a country’s urban centre offers a host of conveniences, such as easy access to facilities, reliable public transport, better career prospects, a happening social scene – you name it.

However, since capital cities are often the political, economic and cultural hubs of a country, they tend to be in high demand, so living there usually comes at a higher price point. But can we say the same for all European capitals? We set out to explore the property market in Europe’s capital cities to find out where you can get the most value for your money, and where you should expect to pay a premium price for a property.

As it stands, the UK Government reports that the average house in the UK is valued at £294,910, so we decided to use this as a reference point. We analysed 44 European cities* in total, taking into account things like property price, size in square metres, number of bedrooms and distance to the city centre, as well as some of the most in-demand facilities and amenities, to find out what you can buy with a budget of approximately £300,000 across Europe.

Pristina revealed as the best-value European capital city to buy a property

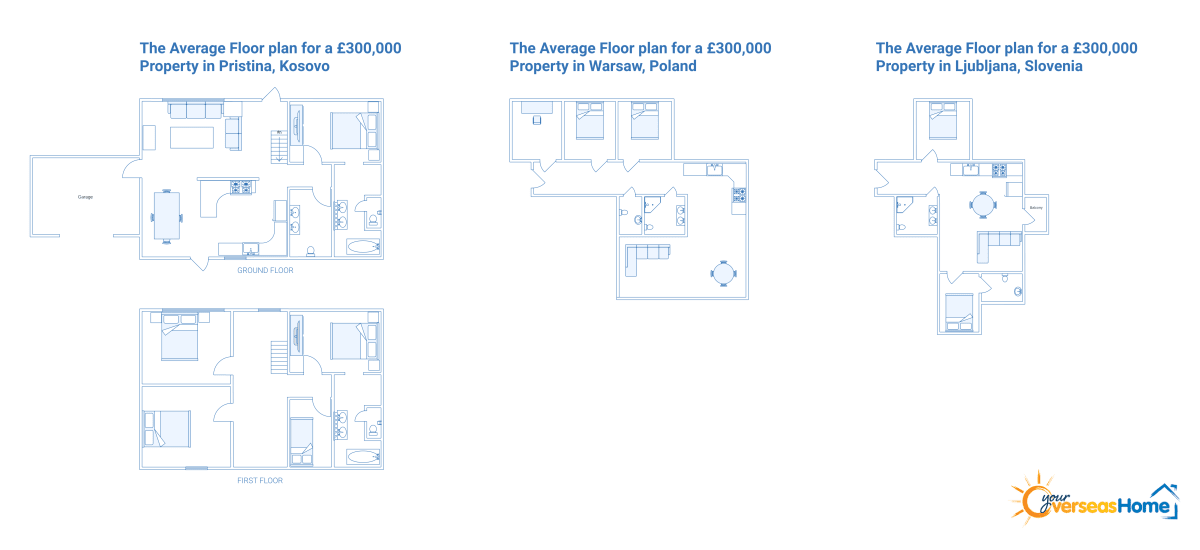

Kosovo’s capital city, Pristina, ranks in first place on our leaderboard for the European capital city that offers the most value for your money when it comes to buying a property. In fact, a budget of just over £300,000 can get you an incredible five-bedroom house, boasting three bathrooms, a garage and a spacious garden, spread out across an impressive 492 square metres.

Pristina may not be your first thought when buying a property abroad, however, it truly is one of Europe’s best-hidden gems. Not only is Kosovo one of the newest countries in the world, but with a young population, affordable lifestyle and up-and-coming, lively capital city, Pristina could be the ideal location to buy a holiday home or move abroad.

Yerevan in Armenia is the second most affordable European capital city to buy a home

Coming in at second place, we have Armenia’s Yerevan. For the same amount of money, you can buy a detached, fully-furnished, three-bedroom house in Yerevan with three bathrooms, a large garden, and a three-car garage. Although still spacious, you can expect slightly less space than in Pristina, with a floor plan of approximately 388 metres squared.

Armenia is best known for its beautiful landscapes and religious history, dating back to 3000 BC. It’s no surprise that over 1.5 million tourists visited last year! However, Armenia, and Yerevan in particular, is also known for its high quality of life, which makes it a great place to live, not just visit. Apart from reasonable house pricing, residents can also enjoy cheap living costs, reliable transport links, and low crime rates.

You are likely to get more for your money in Eastern Europe’s capital cities

Overall, our data reveals that property in capital cities in Eastern Europe offer more value for money than those in Western and Central Europe. Pristina, Yerevan, Sofia, Zagreb, Podgorica, Tirana, Skopje, Baku and Sarajevo all make it to the top ten list for the best-value European capital cities to buy a property

Stockholm is named the most expensive European capital city for property purchase

On the other end of the spectrum, we have Stockholm in Sweden, where a £300,000 budget will get you considerably less than in the Eastern European countries listed above. For this amount of money, you can buy a small villa with just over half the floor space (300 square metres) as Pristina, comprising three bedrooms, 1.5 bathrooms and a parking space.

Generally speaking, Swedes earn considerably more money than the average European worker. This is due to the country’s strong stance on gender and class equality. In fact, the average salary in Sweden is 26,000 SEK, which equates to around £2,122 per month. However, Sweden is also known for its high cost of living, so residents can expect to spend at least 30% of their salary on rent or house payments alone. It is estimated that the cost of living in Sweden is 1.95% higher than in the United Kingdom!

Despite coming in as the most expensive European capital city to buy a property, Sweden is home to almost 30,000 Brits, with the large majority residing in Stockholm. So, what attracts so many Brits to move here? Stockholm is consistently ranked as one of the world’s most livable cities with a high standard of living, excellent healthcare, a high-quality education system, countless career opportunities, and a multicultural population.

Stockholm Skyline Beside Water During Sunset

Dublin property prices are on the rise as demand continues to grow

It’s well known that a long weekend in Dublin can set you back a pretty penny, with accommodation alone costing over €146 per night on average for a double room. But how much does it cost to actually live in Dublin? And is this figure reflective of an expensive housing market too?

Unfortunately, house prices in Dublin continue to rise by almost 9% year-on-year, which means value for money is extremely low for property buyers. The demand for property in Dublin is simply too high! And it certainly does not help that Dublin is the third smallest county in Ireland by area, however, it is the largest by population.

As such, the beautiful city of Dublin takes second place on our leaderboard for the most expensive European capital to buy a property. A budget of £350.000 could get you a one-bedroom apartment with 41 square metres of space, one bathroom and a terrace, without a garden or parking space. So, if you’re looking for a spacious home, Dublin might not be the right choice for you. Yet, if you’re willing to sacrifice on space, Dublin is a stunning location to live, boasting magnificent natural beauty, excellent amenities, a buzzing social scene and a world-leading business culture.

City View at London

London is the third most expensive European capital city to buy a house

As everyone is probably aware, the cost of living in the United Kingdom has been on a sharp incline in recent years, with the cost of inflation reaching a 41-year high at the end of 2022. As a result, house prices across the UK have increased dramatically.

If you’re looking to buy a reasonably sized flat in London’s city centre for £300.000, you probably won’t find it. You’d even be lucky to find a garage for less than £100,000 in the centre of London! However, you can find a charming flat in some of London’s most desirable suburbs for £300.000, such as Putney. Here, you can expect a small space with two bedrooms, one bathroom, and maybe even a mini terrace. Following

Sweden, Ireland and the United Kingdom, Lisbon, Helsinki, Madrid, Vilnius, Oslo, Vienna and Reykjavik also make it to our list of the top ten most expensive European capital cities to buy a property.

The most affordable capital cities in Western Europe to buy a property

Cyprus’s Nicosia ranks first on our leaderboard, providing the most value for money compared to all capital cities in Western Europe. For £300,000, you can enjoy a spacious, modern apartment with four bedrooms, two bathrooms, a large outdoor terrace and parking space – all fully furnished. This makes it the perfect place to move abroad with your family, without compromising on size or style.

After Nicosia, we have San Marino in San Marino, the fifth-smallest country in the world. San Marino is a land-locked country, located in Southern Italy, and situated on the majestic slopes of Mount Titano. Due to its remote location, San Marino boasts outstanding natural beauty, yet, surprisingly, also has one of the lowest unemployment rates in Europe and a thriving economy. To buy a property here, you should expect to pay £300,000 for an apartment with one bedroom, one bathroom, a terrace, and parking space – covering 95 square metres.

Next, Brussels in Belgium makes it third on our list of the most affordable housing in Western Europe’s capital cities. Here, a budget of £300,000 can buy you a furnished one-bedroom house, around 88 square metres, with one bathroom, and a terrace. It’s estimated that over 23,000 Brits already live in Belgium, and this comes as no surprise. Belgium is a magnificent country, best known for its incredible gastronomical scene, architectural landmarks, including a number of must-visit UNESCO Heritage Sites. Brussels in particular offers a high standard of living, including great healthcare, affordable education and well-developed public infrastructure.

Following Nicosia, San Marino and Brussels on our list of the most affordable housing in Western Europe’s capital cities, we have Athens, Andorra la Vella, Berlin, Ankara, Rome, Luxembourg and Valletta.

Moving abroad? Which popular European capital cities offer the best value for money?

Every year, approximately 560,000 Brits move abroad from the UK long-term, with some of the most popular destinations being France, Spain, Portugal, Italy, and Greece, among other European countries. Each of these countries is an incredible place to live, but which of these locations’ capital cities offers the best value for money for prospective home buyers?

Athens in Greece ranks 14th on our list, where you can buy a 73 metre squared, two-bedroom, one-bathroom apartment within a £300,000 budget. Although Athens city centre is an inland cosmopolitan hub, there are also a variety of picturesque beaches you can visit within an hour’s drive. This makes Athens the perfect place to enjoy the best of both worlds.

Buying a property in Rome, Italy, will cost you slightly more than most other European capital cities. In fact, with a budget of just under £300,000, you can afford a basic one-bedroom, one-bathroom apartment, around 50 square metres and 24 km from the main city centre. You can expect to pay a higher price for a property with more bedrooms, a garden, pool, parking or terrace, and closer to central Rome. This puts Rome 24th on our list of the best value European capital cities to buy a property, or 21st for the most expensive – if you want to look at it that way!

There are over 18,000 British people already living in Paris in France, and it’s easy to see why. Known as the City of Love, Paris is home to beautiful architecture, impressive historical landmarks, fine cuisine and much more. Yet, living in such an incredible city doesn’t come cheap. Buying a one-bedroom property with one bathroom within 4 km of Paris city centre will set you back around £300,000. Similar to Rome, you are unlikely to get much more than a basic apartment, around 34 metres squared, without a garden, parking space or similar. Therefore, Paris hits number 41 for best value European capital cities to buy a home.

Finally, taking a look at Portugal’s Lisbon – the fourth most expensive European capital city to purchase a property – almost on par with the United Kingdom, which comes in third place. In Lisbon, a £300,000 budget will get you a two-bedroom apartment within 10 km of the heart of the city, including one bathroom, a terrace, and a parking space.

Which European capital city offers the largest floor space for your money?

When it comes to purchasing a large property, it is clear that capital cities in Eastern Europe offer the most value for your money overall, with Pristina, Bucharest, Skopje, Chisinau, Yerevan, Tbilisi, Sarajevo, Zagreb and Podgorica all making it to the top ten.

However, even when we just compare the size of the properties, Pristina comes out on top yet again, costing property buyers a fantastic £577 per square metre, in comparison to London’s average of £8,091 per square metre!

Following close behind, we have Bucharest in Romania, where it costs £624 per square metre, and North Macedonia’s Skopje at £606 – both still drastically lower than London prices.

That being said, we also have Ljubljana in Slovenia, where it averages a shocking £12,095 per square metre! Housing prices in Slovenia are on the rise due to an increase in demand without supply, therefore, it may not be the ideal destination for home buyers at the moment.

Luxembourg also works out very expensive if you want a large property, with each square metre, setting you back £11,531 on average. It’s a similar story for Paris, however, it is slightly more affordable! One square metre averages at £8,087, which makes it very similar to London prices.

Conclusion

Ultimately, living in Europe’s capital cities certainly has its perks, from easy access to facilities, career opportunities and social scenes. However, the closer you live to the capital city, the more money you should expect to spend on buying a property, and the less value for money you are likely to receive, too.

Each and every capital city has its own appeal, whether that’s incredible natural beauty, rich history, or immersive culture. Yet, although all European capital cities offer their own unique charm, the cost of living in these cities varies greatly. As such, a budget of approximately £300,000 will get you a very different property in each of Europe’s capital cities. While you may be able to live the lavish lifestyle on a low budget in Pristina, your money will not stretch as far in Stockholm! Where you choose to buy will all depend on your personal preferences and priorities, and you may need to make some compromises along the way.

What £300k Can Get You in Europe’s Capital Cities:

Methodology

As of November 2022, the UK government reported that the average property in the UK was valued at £294,910 – just shy of £300,000. So, we wanted to see what the same amount of money would get you in capital cities around Europe.

To do this, we used Google to find one of each country’s top domestic property portal, and searched for properties in the capital city within the €300-330k bracket. Then, we arranged the listings by most popular, most viewed, or most relevant, and selected a property at random in the top 5 listings. This acted as a representative/typical example of the kind of properties available in that area within the price €300-330k range.

We then used the property’s listing to log data against each of the criteria we selected, including price, size, number of bedrooms and bathrooms, distance to the city centre, etc.

Once we had collected all the data, we assigned each data point with a value that would place each country in a unique ranking system based on all of the criteria for each city combined.

*Given the unique situation, we have included all European cities except for Russia and Ukraine, since the current political conflict would not provide an accurate representation of the country’s property market.