The evidence is that despite its year-round warmth and endless menu of exciting activities, buyers from the UK have not been flocking to Florida in recent years. We’ve declined from around 10% of international buyers in 2010 to less than 5% now.

But could that be about to change? Now, with the dollar considerably weaker and the market leaning in buyers’ favour, 2025 offers opportunities.

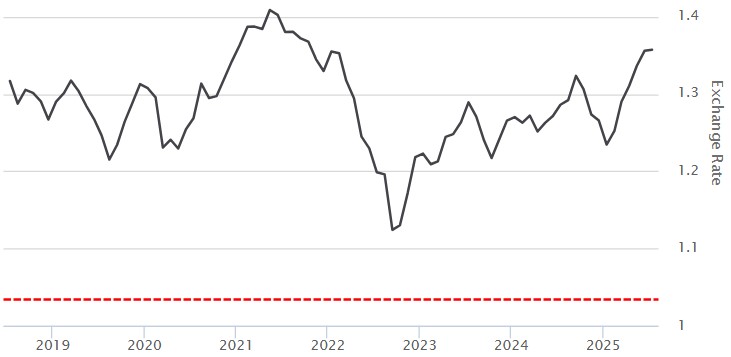

Dollar takes a dive

A weaker dollar and slowing house price growth have made a property purchase in the USA more attractive to British and European buyers since the start of the year.

This has made a $500,000 property in Florida £35,000 cheaper to a UK buyer in the space of just six months

Sterling has gained around 10% against the greenback since January, making a $500,000 property in Florida around £35,000 cheaper to a UK buyer in the space of just six months. The mid-July rate of £1/$1.34 is the strongest sterling has been since February 2022.

Pound to US dollar

It is even better news for European buyers, thanks to the euro’s 15% climb against the dollar. This hike has knocked around €60,000 off a $500,000 house purchase for a European buyer compared to January.

This has knocked around €60,000 off a $500,000 house purchase for a European buyer compared to January.

Europe’s single currency is currently trading at levels not seen since September 2021, not forgetting it dipped below parity momentarily in September 2022 (€1/$0.96), a year described as the euro’s annus horribilis.

Buyer’s market?

This year has seen conditions in the USA shift increasingly towards a buyer’s market. In June, the national median list price remained flat compared to May and rose just 0.2% year-on-year to $440,950. Meanwhile, the National Association of Realtors (NAR), which measures actual sale prices, released its latest median price as $422,800 (May 2025), up just 1.3% year-on-year.

In June, 20.7% of home listings had price reductions, which is 2.3% more than last year.

At the same time, sources show that more sellers are making price cuts. In June, 20.7% of home listings had price reductions, which is 2.3% more than last year. There is an increasing number of homes available to homebuyers too. Inventory across the USA rose 28.9% year-on-year in June, marking the 20th consecutive month of increases.

Sticky mortgage rates continue to inhibit domestic buyer activity, with 30-year and 15-year rates ending a five-week decline in July when they edged back up to 6.72% and 6.67% respectively. All of which indicates a muted market with a re-balancing in favour of buyers – many of whom are waiting for rate cuts. For cash-buyers, which many foreigners are, the last few months of 2025 and start of 2026 could be an ideal time to strike a deal with frustrated vendors.

Cheaper, emptier flights

The re-election of Donald Trump as president, punitive tariffs and his ambush of Ukraine’s President Zelensky in the Oval Office have not endeared the country to some potential buyers, but this too offers opportunities.

According to Cirium, the aviation analytics company, European bookings in February and March for June, July and August were down by 13%. There reports of as much as 75% drops in numbers flying from Canada. Official US data showed showed significant year on year drops since before the pandemic, but these have accelerated in 2025.

Flight prices have fallen accordingly, with ticket prices down by 7-8% year on year on international routes and flight prices down overall by 3.5% in the year to June. The airlines have been saved by internal US flights, first class and other premium prices staying high.

Typical bargains include return flights from London to Orlando on British Airways in the height of summer for less than £500 and in October on Norse Atlantic for just £287.

Championed by the Chinese

The foreign nation buying the most resale property in the USA right now is China, accounting for 15% of the overseas market (volume), followed by Canada (14%) and Mexico (8%). The remaining top ten, according to the NAR report, are India (6%), the UK (4%), Brazil, Colombia, Nigeria and the UAE (all with 3%), and Israel (2%).

Mexico and the UK have both seen gradual declines over the past two decades. For the four years between 2007 and 2010, the UK’s share ranged from 9%-12%, Mexico’s from 10%-13%. Despite that, the value and volume of the UK’s share in 2024-25, namely $2billion and 3,100 units, encouragingly are back to levels not seen since 2021 ($2.6billion and 3,800 units).

Foreigners – how deep are their pockets?

The median price of a resale property purchased by a foreigner in the USA is now $494,400, according to NAR, with the average price standing at $719,000.

The Chinese are the highest spenders, their median and average spends being $759,600 and $1,168,800 respectively. Median spend for UK buyers is noticeably lower at $425,000 (average $636,400). Nearly one-fifth (18%) of foreign buyers are purchasing properties worth more than $1million

Permanent or second home

NAR data for 2025 shows that foreign immigrants buying a permanent residence spend more (median $533,700) compared to foreign second homeowners (median $448,400).

The majority of second home-owners (56%) buy in cash compared to 39% of those moving over permanently. More than two thirds of Chinese buyers (71%) and around three-fifths of UK (61%) and Canadian (57%) buyers purchase outright in cash.

Sunshine State shines above the rest

Florida is the most popular destination with foreigner buyers, attracting 21% of all sales. Second favourite is California (15%), then Texas (10%), New York (7%) and Arizona (5%). Other destinations below 5% included Hawaii, North Carolina, Michigan, New Jersey and Illinois.

Florida is the number destination by some distance with both UK and Canadian buyers, attracting 45% and 48% of those nations sales respectively. California’s popularity is on the rise – it is the top destination among Chinese buyers and the second favourite with UK, Mexican and Indian buyers.

Type and purpose of purchase

The majority (63%) of foreign buyers in the USA purchase detached single-family homes, whether non-resident (60%) or recently resident in the USA (65%). Non-resident buyers (holiday homeowners) have a higher preference for condominiums, with 18% purchasing condos.

Nearly half (47%) of all foreign purchased properties are used as a vacation home and/or rental property. Unsurprisingly, this figure rises to 60% when measuring non-resident foreigners without including recent immigrants.

If the numbers and trends have you considering a purchase across the pond, now could be the ideal time to explore your options. From Gulf Coast gems to bustling inland hubs, Florida offers a diverse range of opportunities for international buyers.

To discover the best locations and properties in the region, take a look at our expert guide on where to buy property in central and western Florida. And when you’re ready to take the next step, our experienced team is here to help – book a free consultation to discuss your plans and get matched with trusted estate agents, legal advisors, and currency specialists.